Toll increase in Germany as of 1.12.2023

In future, the truck toll is to be linked to the level of CO2 emissions. In this way, the federal government ➚ wants to strengthen climate protection and use the earmarked additional revenue to expand infrastructure.

The planned law aims to implement the revised Eurovignette Directive, which was already adopted in March 2022.

One of the key changes in this directive concerns the introduction of a CO2-based differentiation of toll charges for heavy goods vehicles.

Vehicles over 3.5 t will be subject to tolls

From July 2024, the toll obligation for vehicles weighing more than 3.5 tons will come into force. This toll is levied on the basis of the gross vehicle weight rating (GVWR) of the towing vehicle or tractor unit.

Toll Collect will develop a technical solution and provide an on-board unit (OBU) in time to enable automatic toll collection for vehicles over 3.5 tons tzGm.

There will be an exception for craftsmen and similar businesses. An online solution is currently being developed that will enable tradespeople to provide suitable evidence to demonstrate that the vehicles used in their business exclusively meet the requirements of the “tradesperson exemption”.

It should be noted that there are already corresponding exemptions for craftsmen’s vehicles in connection with the rules on driving and rest periods and professional driver qualifications.

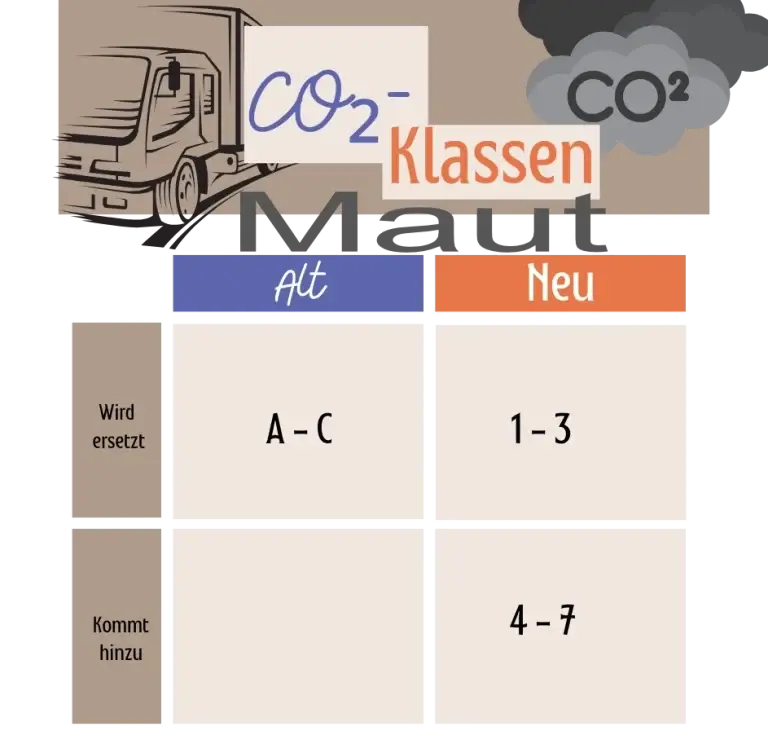

New CO₂ classes

In future, the toll will be levied in seven CO₂ classes. Classes 1 to 3 correspond to the previous classes A to C. Classes 4 to 7 are new and take the CO₂ emissions of the vehicles into account even more precisely.

From January 2024, vehicles powered by natural gas (CNG/LNG) will also be subject to tolls. The toll amount is then also based on the CO₂ classes. Vehicles that bio-CNG are exempt for 2 years for the time being.

Toll increase of 83 percent

The toll increase varies depending on the vehicle and CO₂ class. On average, it is 83 percent. For a CO₂ class 1 truck, the toll will rise from 12.30 euros per 100 kilometers to 22.40 euros. For a CO₂ class 7 truck, the toll will rise from 12.30 euros per 100 kilometers to 32.60 euros.

Effects on transport prices

The toll increase will lead to an increase in transport prices. According to estimates, transport prices for goods traffic on the road will rise by 3 to 5 percent.

The price increase must be passed on to logistics customers by the transport companies.

This means higher costs for shipping and returns prices in e-commerce and stationary retail.

This will have an impact on end customers’ prices either directly or by increasing the price of consumer goods.

Possible measures to minimize the cost of the toll

Transport companies can minimize the costs of the toll increase through various measures. These include:

Improving fuel efficiency: trucks with lower fuel consumption pay a lower toll.

Use of zero-emission vehicles: Zero-emission vehicles are exempt from the toll until 01.01.2026. After that, they pay 75% less on the partial toll rate.

Optimization of transport routes: Efficient planning of transport routes can reduce toll costs.

Criticism of the toll increase

The toll increase is being criticized from various sides. The German Road Haulage, Logistics and Disposal Association (BGL) criticizes that the toll is too high and endangers the competitiveness of the German economy.

The environmental protection organization BUND welcomes the toll increase, but at the same time demands that the revenue from the toll be fully invested in climate protection.

FAQ neue CO2 Klassen

Wie kann die neue Mautgebühr berechnet werden?

Die SVG Cargo App ➚ bietet eine neue Funktion, mit der Sie die alte und neue Maut vergleichen und verstehen können.

Wichtig dabei ist, dass Sie die richtige Emissionsklasse auswählen.

Sie können aber auch anhand der mautpflichtigen Bundesautobahnen und Bundesstraßen die Tariflängen als Abrechnungsgrundlage für die Mautgebühr in der Mauttabelle ➚ nutzen.

Wie finde ich die passende Emissionsklasse?

Um die Mautgebühr richtig zu berechnen, müssen Sie die passende Emissionsklasse für Ihr Fahrzeug finden.

Auf der Webseite toll-collect.de ➚ können Sie anhand des Kennzeichen die passende Emissionsklasse finden.

Welche Fahrzeuge gelten als emissionsfrei?

Als emissionsfreie Fahrzeuge gelten Elektrofahrzeuge, Wasserstoffverbrenner sowie Fahrzeuge mit einer Wasserstoff-Brennstoffzelle.

Diese Fahrzeuge bleiben bis Ende 2025 und sogar dauerhaft bis zu 4,25 Tonnen tzGm von der Maut befreit.

Während LKW mit CNG und LNG ab Januar 2024 mautpflichtig werden.

Fahrzeuge mit regenerativen Kraftstoffen wie Bio-CNG sind für zwei Jahre von der CO2-Abgabe ausgenommen, danach entscheidet der jeweilige Herstellungsprozess des Biomethans, ob und in welcher Höhe eine CO2-Abgabe fällig wird.